Just two months ago, CEOs collectively breathed a sigh of relief, as most countries were implemented, and the big beautiful bill began to cut the juicy corporate tax cuts and low -regulation promises, which give business leaders hope that they finally return to business.

It didn't last long.

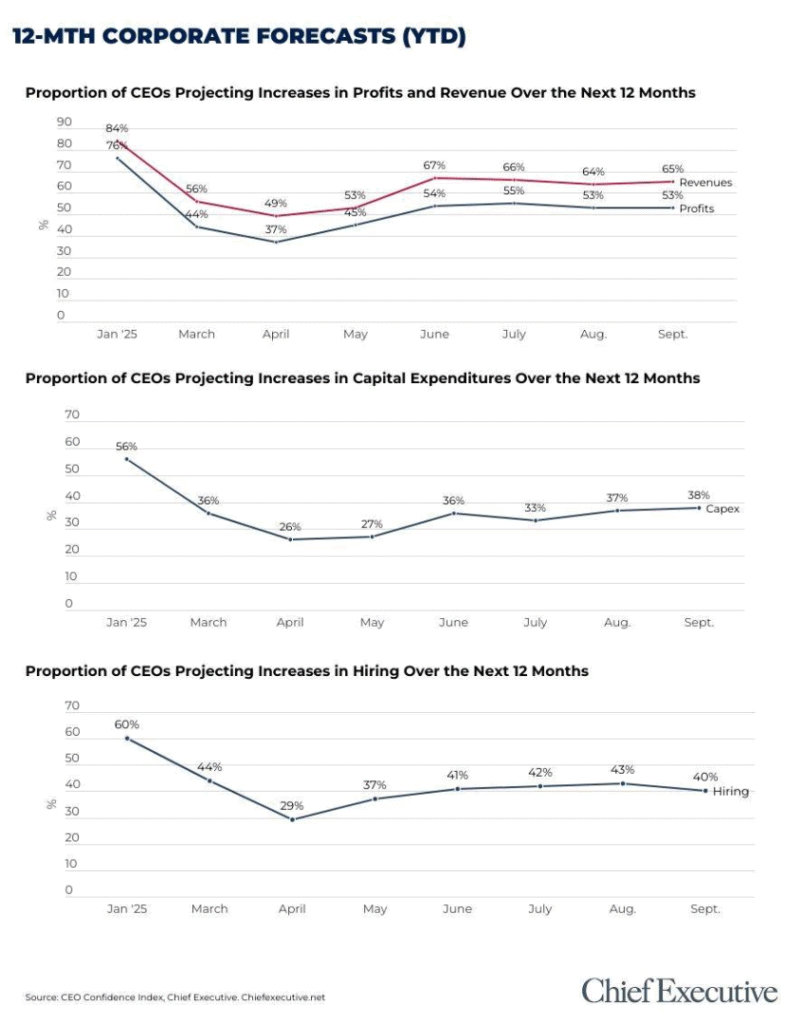

Our September CEO's trust index polling was impartially trapped by the CEO's concept about the current business conditions in the United States, still at the lowest level of the year: 5.1 (a scale measured where 1 is poor and 10 is excellent). It is flat in August 5.2/10, which was less than 8 % since July and 19 % lower than the CEO's concepts in January.

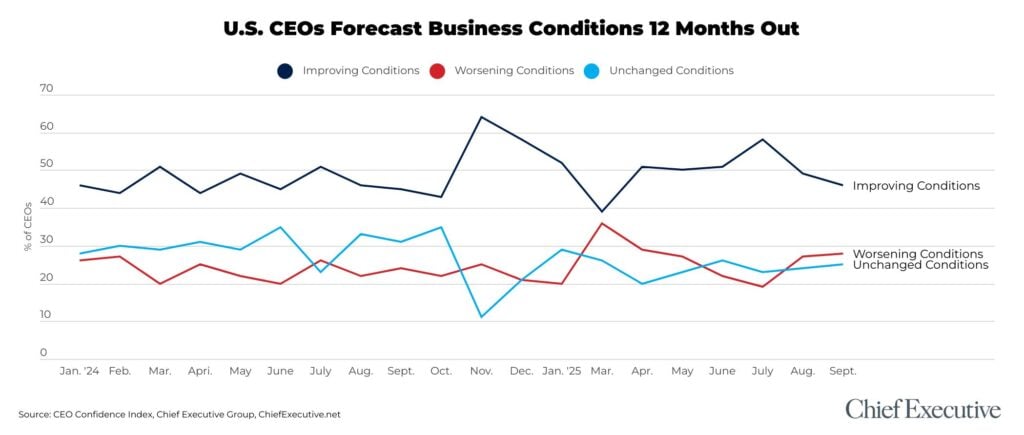

And while the CEOs predicted that the 12 -month economy will reach 5.5/10 from now on – which is 8 % higher than today – their rating is the second monthly decline in their view, which is 5.8/10 in July in July.

“Inexpense and instability by the DC Group CEO David Ramer said,” DCConstability and instability have just made planning difficult, and inflation costs can be absorbed. Now they are being delivered to consumers. It is a rigorous climate to maintain growth. ”

Tim Zimerman, CEO of Mitchell Metal Products, agreed, “Developing tariff environment is reducing business confidence and growing costs.”

The wholesale manufacturer's CEO agreed: “(Outlook) relies deeply on the stability of global trade and taxes. When people move forward every 30-60 days, it is very difficult for people to develop strategies.”

Many of the CEOs said they have seen growing evidence that the Trump administration's policies are starting to slow the overall economy. “(Here) Demand for uncertainty due to taxes. We keep looking at several sections of our business, which is cautious in their business by consumers, including very strict inventory management, as they wait to see how the revenue is finally eliminated.”

“The administration's policies cannot be predicted and they can create an environment that is conducive to stagnation.”

Nevertheless, some are seeing improvement in pipelines and keeps hopeful that this period of uncertainty will lead to a better business environment.

“The tariff situation is currently freezing many consumers by buying capital goods,” said the CEO of a PE -backed global manufacturer. If this strategy can be stable, and interest rates may be reduced, things should be improved.

“Even despite the noise of all taxes, inflation is not so bad … especially on products manufactured in the United States, when a year, when tariff concerns are eliminated, exile,” said Andrew Lee, CEO of LY Brothers Corporation.

Overall, only 46 % of the CEOs in the survey said they now expect next year's economic approach to improve, which is equal to the CEO ranking after March and in 2024. In September, the situation increased by 28 % compared to 2024, expected to worsen in the next year.

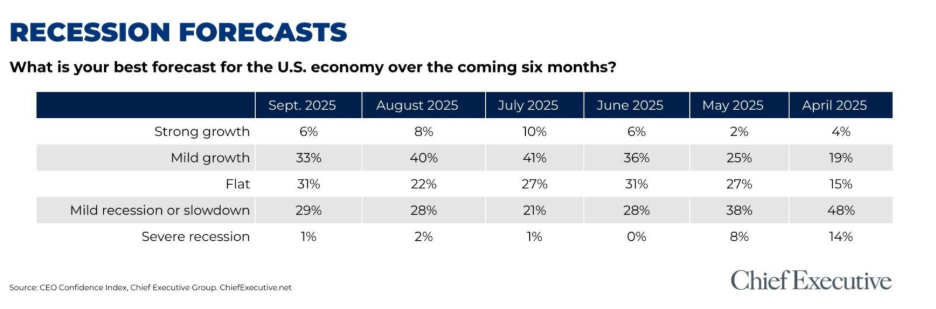

Difficulties of recession

In our September polling, 29 % of the survey said that they now expect recession in the next six months, 28 % last month and 21 % in July (48 % feared during tariff rollout in April). The number of CEOs expecting growth in the next six months has dropped from 48 % last month to 39 % in this month's survey.

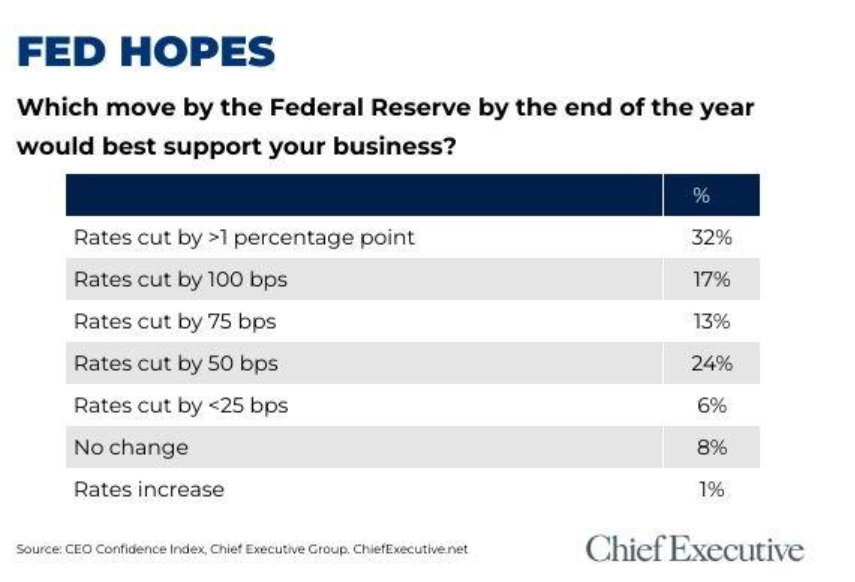

The character of the feed

Asked what they would like to see from the Federal Reserve by the end of the year, 92 % of the CEO replied that they wanted to see a deduction at a deep rate. About two -thirds said they were hoping that the feed would reduce the rates by at least 75 points, demanding one percent or more. Only 6 % said they would be happy with 25 BPS kit.

If the feed does not provide expected deductions, the CEO expects that this will result from “flattened” and from margin pressure to wider economic tension, including delayed capital investment, holidays and low demand.

“Without the stimulus of the economy, I expect consumer sentiments and a weakening economy,” said the CEO of a North American entertainment company.

The CEO of a staff agency said, “The organization will potentially need to create a small scale and protect the profit, while looking for many strategic measures to reduce new products and labor through automation.

“Consumers will be added extra and need to increase wages,” said the CEO of the family -owned business.

“We will seek to reorganize our business and possibly shutter capacity,” said the CEO of a public trading consumer manufacturing company.

Years ahead

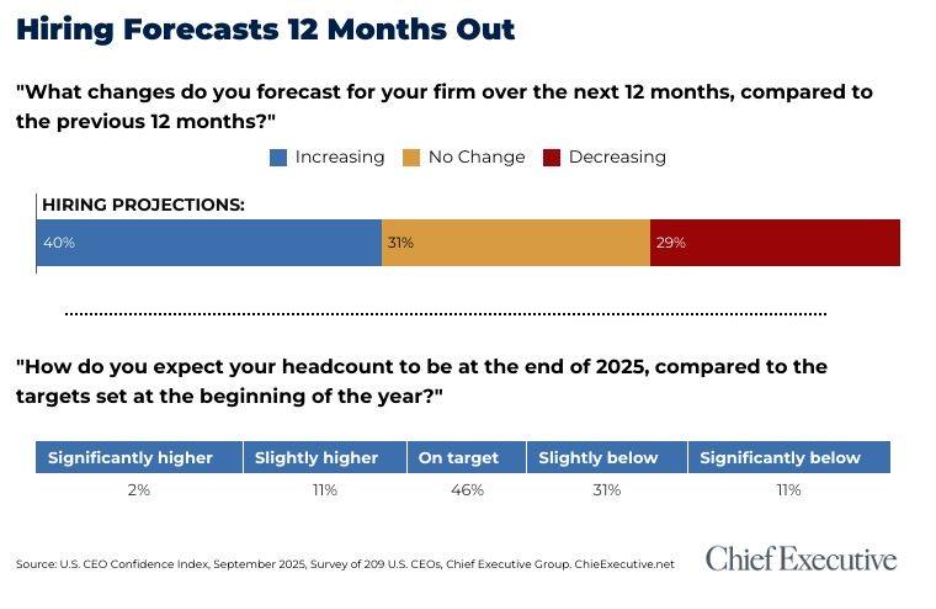

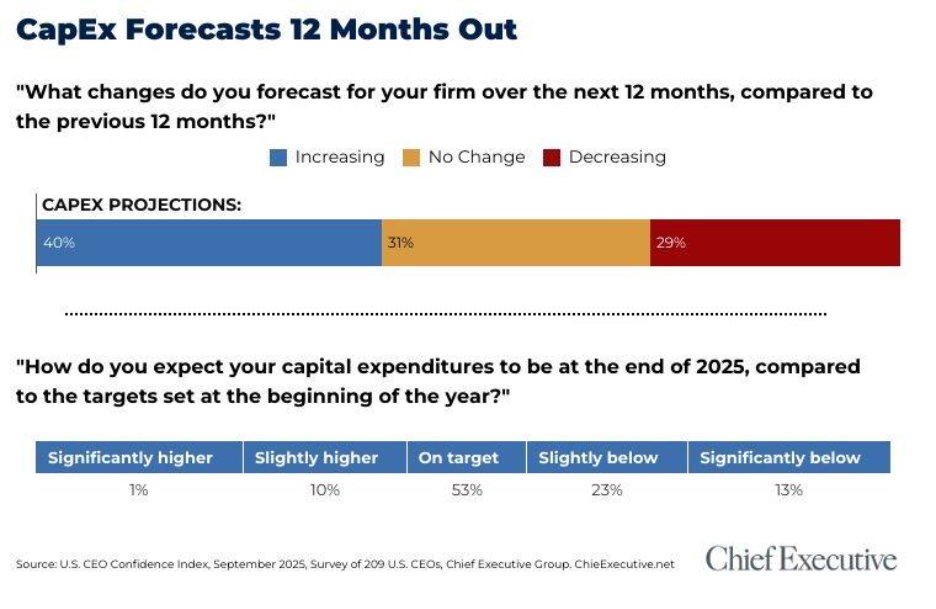

Corporate predictions for next year have been quite stable in the past few months, but the CEO says their companies are still less than their 2025 goals.

- 65 % expect revenue rise in the next year, but 57 % say they expect to end the year below their 2025 target.

- 53 % expect profit in the next 12 months, but 54 % expect the year to end below the target.

“The growth is mostly stealing market share from rivals who are laying people and cutting services,” said a CEO. “We are eligible to be in high contact with customers and allow us to take the market share because of being private with less heads than our rivals.”

When it comes to a job, the CEO is divided: while in the next 12 months (49 % is less than 2024 than average of 2024), only 40 % plans to increase, 46 % say they are really targeting for years – and 41 % say they are less than goals.

Of those lower than the targets this year, most of the overall cost of labor and skilled, dependent workers have been charged with difficulty finding as the primary head wind, though many have mentioned the AI to take advantage of this gap.

An area is increasing the trend: capital costs. While in the next 12 months, only 38 % of these investments are planned (less than 46 % in 2024), 53 % say they are on the way to the target of 2025 on the target.

Perhaps a little good news is that the impact of inflation at the cost of doing business is relaxed: now 66 % of the CEO expects operational costs to continue to rise next year, versus 81 % in April.

About the CEO confidence index

Since 2002, the Chief Executive Group has been polling hundreds of US CEOs in all kinds and size organizations, to compile our CEO confidence index figures. The Index detects confidence in the current and future business environment based on observations of various economic and business components of the CEO. Additional information about the index and earlier months of data, Chief Executive. Net/CEO-CONFIENCE-INDEX/See